Good morning. It's Monday, March. 25 and we're covering how to turn side hustles into a six-figure business, how real-time payments can right-size small business cash flow, rules that helped set real estate agent commissions, and much more. | First time reading? Sign up here. | Stock Market Update | | | | | Market Performance: March 22, 2024. | Stock futures were slightly lower Sunday evening ahead of March's last—and shortened—trading week. Futures tied to the Dow Jones Industrial Average edged lower by 37 points, or 0.1%. S&P futures and Nasdaq 100 futures lost nearly 0.1%.

The market is on track for its fifth consecutive month of gains, with the major U.S. stock benchmarks crossing new all-time closing high levels last week. The S&P 500 added roughly 2.3% last week, while the Dow gained just under 2% for its best week since December, nearing the 40,000 level. The Nasdaq Composite, meanwhile, jumped about 2.9% during the period.

These gains were fueled by the Federal Reserve's latest remarks that maintained central bankers' rate-cutting timeline for this year, as well as investors' ongoing enthusiasm for tech stocks amid the AI-powered rally.

Overall investor sentiment remains above its historical average, according to the latest weekly American Association of Individual Investors Sentiment Survey, reflecting persistent market optimism. Still, some investors fear the potential impact of an overextended rally and higher-for-longer interest rates. |

| |

| | |

| | Financial Maverick Insights | | | | | How I Turned My Side Hustle into a Six-Figure Business | Side hustles don't have to mean career burnout, as long as you have boundaries. And they're a great option for career cushioning. Turning my side gig into a main source of income now finances my five kids' futures, supports my own desire for a creative career and offers a flexible part-time workday. And I teach others to do the same. If elevating your side hustle, freelance work, temp job or consulting gig is on your career vision board, here's what I've learned.

Find a mentor, be a mentor

We've all heard the sayings about only being as strong as the women (and others) who surround you, and reaching back to pull others up by the hand. This has been done for me, and I've done it for others. The first step in making your side hustle your main hustle is to find someone who has done it, and learn from them. Sometimes, this looks like paying them for advice, and sometimes, it's a cup of coffee and a conversation. Attend events, hang out and network in the same circles as they do.

Niche down—or not

Some common advice with side hustles is to "niche down" and get really specific with your goals. Niche down means to specialize in a specific area and clarify which niche of your market you fill—and how. It's the opposite of being a jack of all trades. Maybe your side hustle is making soaps, but your niche might be making organic soaps or products for kids.

Craft a stellar statement

What's the purpose of your business? You've created a side hustle—and future full-time gig—that's flourishing, but what exactly do you or your brand offer? In a few simple sentences, provide a roadmap for yourself or your business so potential customers or clients (or in my case, editors) know what to expect.

Build your online presence

For any side hustle, a clear and helpful online portfolio or LinkedIn bio is essential. From there, a heavy presence showcasing your best work is a must. The how and where and what will depend on your industry, but anyone should be able to head to both those places to see what you're about. Don't get caught up in making it perfect from the get-go. Just start, and add a bit each day, week or month.

Don't overthink bookkeeping

If you are DIYing your bookkeeping at first, think meticulous, not fancy. You do not have to have an elaborate software program for invoicing or project management (though there are plenty of beneficial ones out there to look into). Instead, simply keep a detailed spreadsheet of your projects, costs, income and expenditures. Work with a qualified accountant who knows how to help freelancers to ensure your taxes are in line. The rest can level-up later. |

| |

| | |

| | | | | | How Real-Time Payments Can Right-Size Small Business Cash Flow | Small and medium-sized businesses (SMBs) haven't been able to catch a break in recent years. But tough times make tough companies. Still, after emerging straight from the pandemic years into a record inflationary environment juxtaposed against rising interest rates and ongoing macro and geopolitical hostility, one thing has remained constant for firms looking not just to survive but to thrive: the importance of cash flow management.

Even so, for those firms looking to be proactive and strategic about their access to working capital, legacy payment methods with inherent delays can create uncertainty and make it difficult for SMBs to gauge their financial positions accurately.

"Legacy systems are slow, for starters, and batch-based so they tend to favor predetermined transactions like payroll or recurring bill pay, which leaves out a lot of ad hoc and other on-demand use cases where real-time money movement is critical," Drew Edwards, founder and CEO of Ingo Money, told PYMNTS.

Removing Financial Uncertainty for Main Street SMBs

Fortunately, Edwards said that good news is on the horizon and is even already here with many lenders for those SMBs historically underserved relative to their larger peers by legacy payment processes. That's because the emergence of real-time payments offers a potential game-changing solution. By enabling on-demand transfers powered by the new Real Time Payments system, money can be available 24/7 to significantly improve SMBs' daily cash flow, providing them greater financial control and flexibility.

Scaling the Widespread Adoption of Real-Time Payments

While the potential benefits of real-time payments are evident, widespread adoption among SMBs depends on their banks' readiness to implement faster payment solutions. "If an SMB is banking with somebody that doesn't offer RTP, that's what's holding up the adoption, not the SMB choosing not to use RTP," explained Edwards. That's because SMBs typically rely on their banking institutions to offer real-time payment capabilities, and if their bank has not implemented these systems, they won't be able to take advantage of the benefits.

As the payment landscape evolves, embracing real-time payments can be a game-changer for SMBs, offering them a competitive advantage in today's fast-paced business environment by building a faster, more efficient future. |

| |

| | |

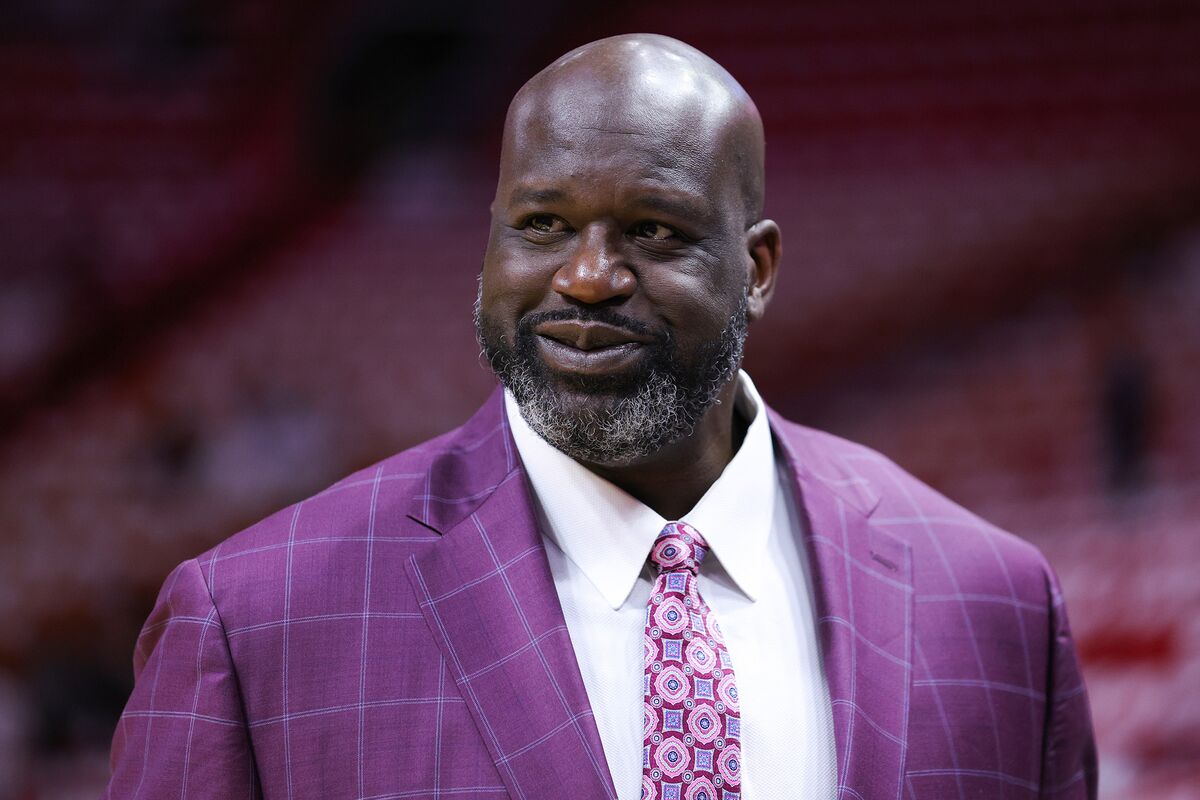

| Real Estate News |  | Shaq Wants His Investments to Be Life-Changing | Deals are happening in sports. Plus: Banks and commercial real estate, explained. |

|

|

|  | Rules that helped set real estate agent commissions are changing | The policy changes could help spur price competition for agents' services and lower the cost for sellers. |

|

|

|  | Selling your home could boost your nest egg — but is it worth it? | A 2023 report from investment firm Vanguard estimates that about a quarter of Americans age 60 and over could move to a cheaper housing market and use the equity in their homes to upsize their retirem... |

|

|

| | Personal Finance Tips |  | Electric Heat vs Gas Heat: Which Is Cheaper? | The choice of electric heat vs gas heat could have a big impact on your energy bills this winter. |

|

|

|  | How planting can save you money at the grocery store | As temperatures warm up throughout the country, grocery prices refuse to cool down. The USDA reports that grocery and supermarket food prices in January were 1.2 percent higher than this time last year and projected to increase through 2024. |

|

|

|  | 16 Side Hustle Ideas You Can Start Today | If you're looking to pay down debt, start a business, or just get some extra cash, a side hustle can help you reach your goal. Here's how. |

|

|

| | Alternative Investing |  | What the NFL and Elon Musk's Neuralink share in common | Emerging tech promises to heal brain damage, but neuroscientists are right to urge caution against Musk's hype. |

|

|

|  | Renowned Investor Jim Rogers Expects All Cryptocurrencies to 'Disappear' — Says Bitcoin Will 'Go to Zero Someday' | Veteran investor Jim Rogers, who co-founded the Quantum Fund with billionaire investor George Soros, expects all cryptocurrencies, including bitcoin, to disappear someday. |

|

|

|  | 3 'Strong Buy' Stocks To Invest In For The Next Wave Of AI | Artificial intelligence (AI) is revolutionizing various sectors, propelling the stock market to unprecedented heights. With the global AI market poised to exceed $1 trillion by 2030, the frenzy surrounding AI is justified. |

|

|

|

|

| | Do you expect all cryptocurrencies to disappear someday? | | | Reach Over 100,000 Financial Mavericks | Advertise with Financial Maverick to get your brand in front of the Financial Gurus in the world. The Mavericks are high-income and highly knowledge people who are always looking for an interesting product or tool. | | | Share Financial Maverick | Calling all Financial Mavericks! To help out a family and friend in need by sharing this newsletter. Tell you what if you ever wanted to be a Hero, Financial Guru, or a Nice Person this is your time! | | | DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research. | |

|

No comments:

Post a Comment