Good morning. It's Saturday, March. 02 and we're covering tips to help you pay your tax bill, how to create a winning money mindset, housing market signs of picking up, and much more. | First time reading? Sign up here. | Stock Market Update | | | | | Market Performance: March 01, 2024. | March arrived with a bang on Wall Street as stocks set new records, fueled by a promising inflation reading and a relentless tech rally, which saw Nvidia closing with a market cap above $2 trillion for the first time.

The S&P 500 (^GSPC) gained 0.8%, setting a new high. The S&P 500 has risen 16 out of 18 weeks, chugging along after passing 5,000 for the first time last month. The Dow Jones Industrial Average (^DJI) rose 0.2% or just under 100 points, while the tech-heavy Nasdaq 100 (^NDX) rose 1.1%, claiming a record of its own for the second day in a row.

Stocks are kicking off March with an upbeat reaction to PCE data that showed inflation continued to cool — easing worries the Federal Reserve would get more reason to hold off from interest rate cuts. But further scrutiny has highlighted signs of "sticky" inflation that will be harder to shift. |

| |

| | |

| | Financial Maverick Insights | | | | | Owe the IRS Money? This CPA Shares Tips to Help You Pay Your Tax Bill | Tax day is inching closer -- and if you haven't filed your tax return yet, it's time to get started. But filing your taxes can be daunting, especially if you're facing a hefty tax bill.

Whether your tax bill caught you by surprise or you need more time to pay it in full, you have options. I talked to Logan Allec, a certified public accountant and CEO of Choice Tax Relief, to find out what you should do in this situation.

Don't delay filing your taxes, even if you can't afford to pay

Filing your taxes is required by law. And not doing so can result in even bigger problems than avoiding payment, Allec said. "If you can't pay, please file," Allec said. "The penalties for not filing are more stern than the penalties for not paying."

Set up an IRS payment plan

If you owe state or federal taxes and can't afford to pay one lump sum, the best bet is to set up a payment plan, Allec said. The IRS offers a short-term payment plan that lets you pay the debt in full within six months if you owe less than $100,000 in taxes, penalties and interest combined. There's no fee to set up the plan, but keep in mind that penalties and interest will still accrue. You can set up the payment online.

See if you qualify for hardship assistance

Depending on your financial situation, you may find some financial relief if you can't afford an IRS payment plan through the Hardship Assistance program, Allec said.

Don't ignore the IRS

If you don't set up an agreement with the IRS, don't neglect their letters. This could indicate to the IRS that you're refusing to pay, and the agency may take more drastic measures. |

| |

| | |

| | | | | | How to Create a Winning Money Mindset | Vivian Tu is our rich BFF...and yours, too. You may recognize the former Wall Street pro turned-financial literacy influencer as an honoree in PureWow's 24 in '24 roundup this year, and for good reason:

Tu has taken to social media to teach an audience of over two million everything we wish we knew about money (like how to get it, how to save it, and how to spend it.) Ahead, PureWow chats with Tu about the financial tools we wish were taught in school instead of Pythagorean theorem, like the art of negotiating.

PureWow: Ok, Vivian – there are so many questions I have on my mind, but the first being a common one I see amongst women in their early to mid-twenties: What is the biggest misconception about credit cards?

Vivian Tu: The biggest misconception about credit cards is that there is a "best one." There are some that are stunning. They are heavy, made of metal and feel luxurious. Still, there is no such thing as a best credit card. However, there is a best credit card for you, based on your spending habits.

PW: And is it true that having a bunch of credit cards is "bad"?

VT: Not at all. I would say three to five cards is the sweet spot; different cards for different types of purchases. For example, you can pay your rent with the BILT card from Mastercard – that's huge for anyone in NYC where rent tends to be our largest expense, and something we have to pay anyway.

PW: Taking notes! I remember reading that you had a female mentor when you first got to Wall Street that made a big impact on your interest in the financial landscape. What is one piece of advice she gave you that you can pass down to us over here at PureWow?

VT: Number one: Don't get botox off of Groupon! Two, that you can only save as much as you earn, but you can always earn more money. We talk so much about the avocado toast, the latte and the little things that are preventing you from your goals, but the easiest thing to do to have more money, is to make more money. Think about what it costs you to cut $5,000 of discretionary expenses out of your life: you are probably not having fun anymore. You don't have a Netflix subscription, you're not getting drinks with friends, your nails aren't painted. |

| |

| | |

| Real Estate News |  | 36% of homebuyers and sellers don't know they can negotiate real estate agent fees. Here's how to do it | Many homebuyers and sellers don't know they can negotiate real estate agent fees. Of those who try, a majority successfully lowered the fees. Here's how. |

|

|

|  | Housing market shows signs of picking up | The number of mortgages approved increased in January but analysts say the sector is still weak. |

|

|

|  | Barbara Corcoran Says, 'Forget About Florida,' Move Here for Cheap Homes | If you're looking for affordable real estate at a value, money expert Barbara Corcoran knows where you need to move. The real estate mogul was a guest on "Elvis Duran and the Morning Show" recently.... |

|

|

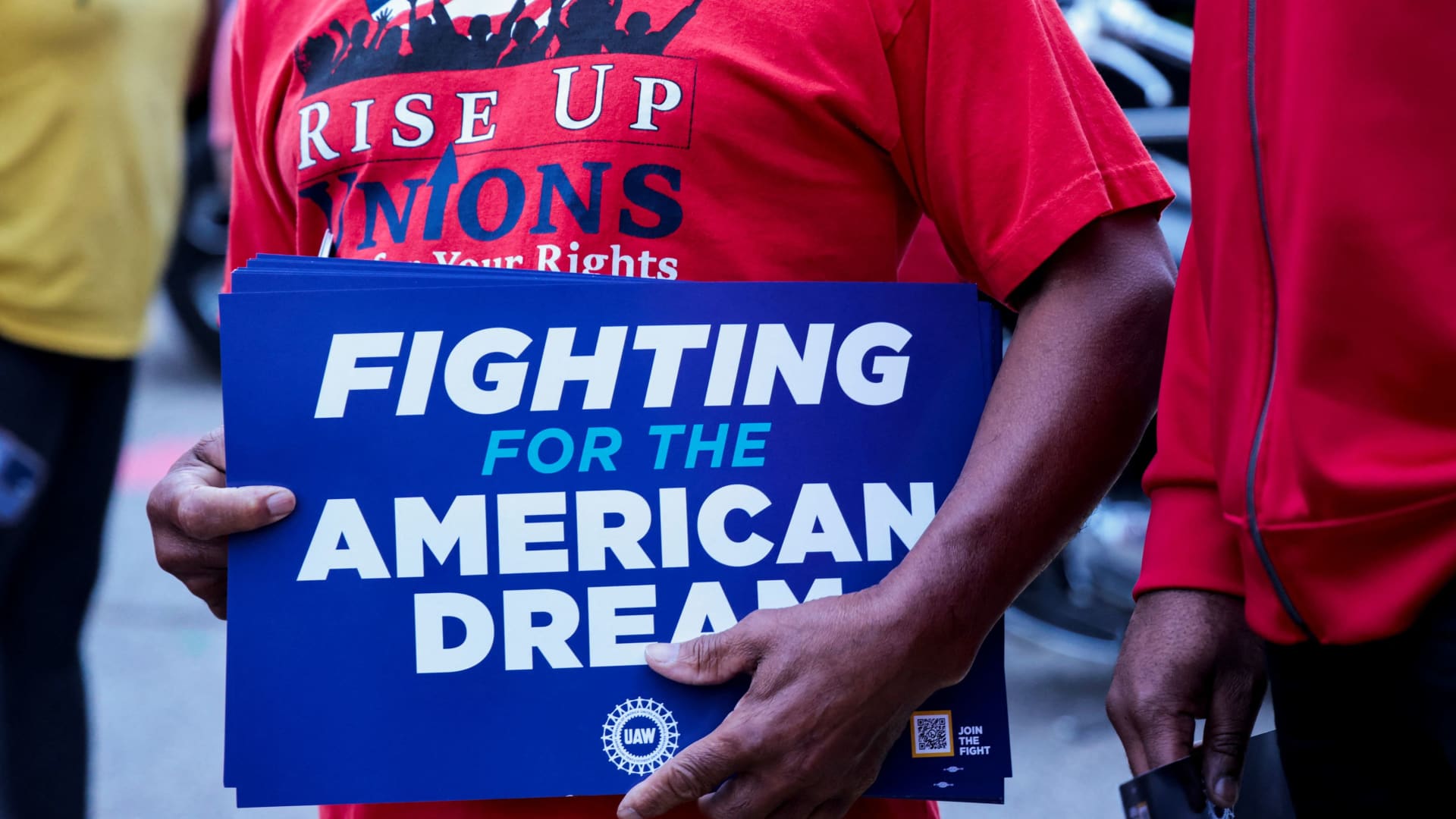

| | Personal Finance Tips |  | Many workers believe pensions are key to achieving the American Dream. But getting those plans back isn't easy | Responsibility for retirement savings has shifted from employers to employees. Now, there's new debate as to whether that change has benefited workers. |

|

|

|  | How to save money fast: 20 ways | These simple moves can help build a cash cushion. |

|

|

|  | Why Don't Some Millennials Want Kids? They Say It's Too Expensive - NerdWallet | A new NerdWallet survey finds that just 25% of millennials who don't have kids plan to have them. A major reason why some are opting out? The high cost of raising children. |

|

|

| | Alternative Investing |  | Is Kara Swisher Tearing Down Tech Billionaires—Or Burnishing Their Legends? | She has long sought to be the best-connected of the tough reporters and the toughest of the insiders. Balancing those goals isn't always easy. |

|

|

|  | U.S. Government Crypto Wallets Transfer Nearly $1B of Bitcoin Seized From Bitfinex Hacker | Wallets containing bitcoin seized by the U.S. government in the notorious Bitfinex hack – later leading to guilty pleas for Ilya Lichtenstein and Heather "Razzlekhan" Morgan – have suddenly become active. |

|

|

|  | What Companies Should Consider When Investing in AI | While many organizations already use AI, its potential may be just beginning. AI can transform productivity and is expected to contribute $15.7 trillion to the global economy by 2030, according to PwC's Global Artificial Intelligence Study. |

|

|

|

|

| | Do you track your credit card score? | | | Reach Over 100,000 Financial Mavericks | Advertise with Financial Maverick to get your brand in front of the Financial Gurus in the world. The Mavericks are high-income and highly knowledge people who are always looking for an interesting product or tool. | | | Share Financial Maverick | Calling all Financial Mavericks! To help out a family and friend in need by sharing this newsletter. Tell you what if you ever wanted to be a Hero, Financial Guru, or a Nice Person this is your time! | | | DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research. | |

|

No comments:

Post a Comment