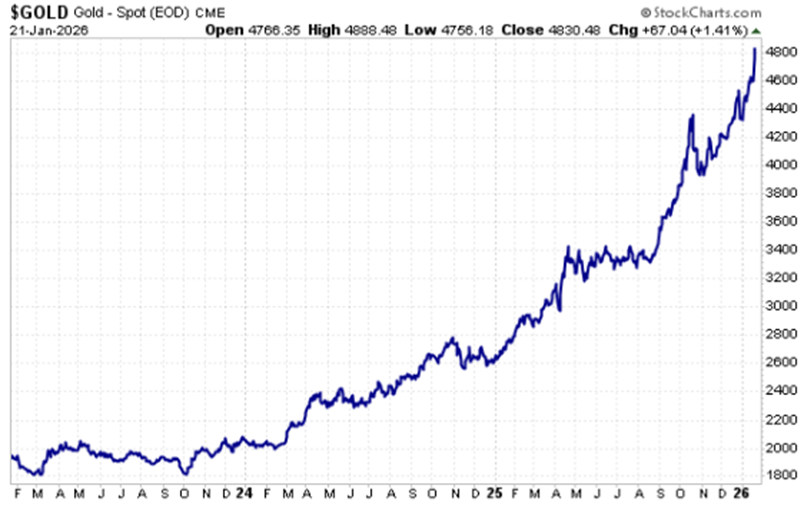

Why Gold's Rally Can Continue in 2026 and What It Tells Us About the Next Market Shift VIEW IN BROWSER I’ve never been what you might call a “gold bug.” Gold bugs are usually the kind of folks who seem to enjoy being in a bad mood. Many of them are permanently bearish on the market. They like to point to things like government deficits, make philosophical arguments about fiat currency – and there’s always a crash that’s just around the corner. That’s just not my style. But you may have noticed that gold prices have continued to meander higher since the start of the year, setting new record high after new record high. In fact, if you’ve been paying attention to the market at all, you know this isn’t anything new. Gold has been on a historic rally for quite some time now.  As you can see in the chart, this move didn’t happen overnight. Gold prices broke above $2,400 per ounce around August 2024 and have been trending higher steadily, building momentum over months. Now that prices have roughly doubled since then, a lot of investors are wondering whether this rally can continue. In today’s Market 360, I’m going to explain why I believe it can. The reality is that several powerful forces have driven gold’s historic move, and importantly, every one of those forces remains in place today. Now, my followers and I have been positioned for this rally for a while. I wish I could say we caught the very first dollar of the move. But what matters more is this: my system helped us recognize a shift in the market early and adjust our positioning accordingly. And that’s the real lesson here. So, if you’ve missed some of the action so far, don’t worry. I’ll also show you the best way to profit from this trend going forward. Finally, I’m going to walk you through an even more important market shift that’s beginning to take shape right now, one that could catch most investors flat-footed. I’ll explain what’s changing, why it matters, and how you can prepare before the crowd finally realizes what’s happened. Gold's Rally Didn't Happen by Accident One of the main reasons gold prices have soared over the past year is that global central banks have been buying gold hand over fist. Gold is a legitimate reserve currency for central banks, and they have been steadily increasing their exposure. At the same time, a lot of investors around the world are not particularly happy with central banks or their policies. Years of aggressive intervention, ballooning deficits, and constant policy reversals have eroded confidence that monetary authorities are fully in control. There’s also a bigger global backdrop here that helps explain why gold buying has been so persistent. Outside the U.S. and India, population growth is slowing or outright shrinking across much of the world. Europe is shrinking. Most of Asia is shrinking. When countries lose households, it becomes very difficult to grow their economies, and that creates powerful deflationary pressure globally. Central banks cannot fix that problem with policy alone. We’re seeing it most clearly in places like China, which has been battling deflation for years now, and in parts of Europe and Japan, where growth remains elusive and deficits are becoming harder to finance. Large institutional investors understand this, which is why bond markets are increasingly policing fiscal behavior in countries like Britain, France, and Japan. Against that backdrop, it’s not hard to understand why so many investors are frustrated with central banks around the world. Gold buying has been relentless because it represents an asset that exists outside a system facing long-term structural challenges. There’s also a fair bit of geopolitical uncertainty driving demand for safe havens like gold, from tensions in the Middle East to the ongoing war between Russia and Ukraine. I also suspect many crypto investors will continue shifting toward gold this year, simply because gold has outperformed crypto by a wide margin over the past year. What’s more, if global central banks continue cutting key interest rates in 2026, gold prices should continue to benefit. Gold remains an alternative to cash, and as interest rates decline, the opportunity cost of holding gold declines as well. In short, gold is a viable alternative to your bank account. It cannot be created by governments. It is not someone else’s liability. When confidence in fiat currencies declines, even gradually, gold tends to attract capital. And since it tends to “zig” when the rest of the market “zags,” it’s worth a look for any investor, whether you’re a gold bug or not. The fact is that the demand for gold has been broad, persistent and driven by long-term forces, not short-term speculation. But there’s an important distinction investors need to understand. Owning gold is one way to play this, but it’s not the only way. And historically, it hasn’t been the most profitable way either. During sustained gold bull markets, the biggest gains often do not come from the metal itself. They come from the businesses that benefit most when gold prices rise. I’m talking about gold mining stocks. | Recommended Link | | | | By the time Tesla made headlines, the big gains were gone. Elon’s potential Jan 26 launch could be 10X bigger — and I’ve found a backdoor play. See it here. |  | | The Case for Gold Mining Stocks The simple fact of the matter is that if you’re only investing in gold by buying physical bullion (or coins) – or even an exchange-traded fund that aims to track the price of gold, you may be leaving serious money on the table. Here’s why. During gold bull markets, the real profit potential often lies not in the metal itself, but in the companies that mine it. The reason is leverage. Gold miners operate with largely fixed production costs. Their labor, equipment, energy and infrastructure expenses do not change much just because gold prices move higher. But when gold prices rise, their revenues increase immediately. That causes margins to expand. Cash flow improves. Earnings power rises faster than the price of gold itself. In other words, a modest move in the metal can translate into a much larger move in the stock. That’s why, historically, well-positioned gold miners have often outperformed gold by a wide margin during sustained bull markets. It happened during the 2000 to 2011 gold bull market. We saw it again from 2015 through 2020. And we’re seeing it again today. That’s great news for the 16 gold stocks that we currently own in Accelerated Profits. We’ve gradually added these mining stocks to our Buy List throughout 2024 and 2025. And in nearly every single instance, they’ve outperformed the price of gold. In fact, we added our biggest winner in September 2024. And while gold is up a little more than 90%, this mining stock is up more than 240%.  Given these factors, it’s not too surprising that our gold stocks have had an excellent start to 2026. The gold stocks we own are up strongly on average so far this year, with broad participation across the group. The point is that this isn’t about one lucky pick or a single headline-driven spike. It’s exactly how leadership tends to look when a shift is underway but not yet obvious to the broader market. Just as important, just because it’s obvious now does not mean the opportunity is over. We aim to hold on to many of our gold stocks – while selectively pocketing some gains along the way. But the bigger takeaway here is not simply that gold stocks are working. It’s that this is how market leadership changes before most investors realize what’s happening. Gold has been a clear case study in that process. Another Leadership Change This brings me to the more important shift I mentioned earlier. Gold did not surge all at once. It moved gradually, then all at once. Most investors did not notice the shift until it was obvious. Market leadership changes the same way. It rarely collapses overnight. Instead, familiar winners stop making progress. Prices go sideways. Relative performance deteriorates. Meanwhile, a new group of stocks begins to quietly take the baton. At first, most investors dismiss it. Then they rationalize it. And eventually, they wake up and realize the market they thought they were in no longer exists. That’s exactly the risk I see building now, particularly in many of the AI stocks investors know and love. These stocks do not need to crash to cause damage. They can go flat. They can drift lower. They can underperform quietly while capital rotates elsewhere. For investors who remain heavily exposed, the result is the same. Lost time. Lost opportunity. And growing frustration. This is what I’ve been calling a Hidden Crash. It’s not a dramatic market meltdown. It’s a leadership breakdown that happens quietly, while the major indexes still look fine. According to my research, many of the well-known AI stocks that have carried the market for years are showing signs of fatigue. That’s dangerous, because when market leadership fades, it usually does not happen with a single headline or a sudden collapse. It happens through underperformance and opportunity cost. At the same time, a new group of AI leaders is already beginning to emerge. That’s why I recently delivered a special presentation explaining exactly how these leadership transitions unfold, what signs I’m watching beneath the surface of the market, and how investors can reposition before the shift becomes obvious. If you wait until everyone agrees that the leadership has changed, it will already be too late. To see what I believe is coming next, which AI stocks I think are at risk, and where I see the next leaders forming, click here to learn more about the Hidden Crash and how to position for it now. Sincerely, |

No comments:

Post a Comment