ON FEBRUARY 24, PRESIDENT TRUMP IS

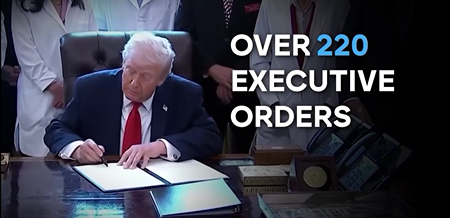

EXPECTED TO SIGN HIS FINAL ONE — EVER! Ian King here with some very big news. After 220 Executive Orders in one year. And with nearly three full years left in office… I have learned the unthinkable… On February 24th, President Trump is expected to issue what I believe will be his FINAL Executive Order. I know that sounds crazy … I didn’t believe it myself. But then I saw all the details of the leak — coming directly from inside the White House — and I knew right away this was going to be a huge and shocking announcement. I was able to get the full story for you here. Regards,

Ian King

Chief Strategist, Strategic Fortunes

Exclusive News What to Make of D-Wave's Latest Defense Industry PushWritten by Nathan Reiff. Date Posted: 2/10/2026.

Key Points- D-Wave Quantum's partnership with defense industry firms Davidson Technologies and Anduril Industries has already yielded a 9% to 12% improvement to threat mitigation for air and missile planning scenarios.

- The partnership expands on an existing collaboration between D-Wave and Davidson, announced last year, in which D-Wave installed an Advantage2 quantum system at Davidson's Alabama headquarters.

- The big question for investors is likely to be how this may translate into sales agreements for D-Wave, but answers remain unclear.

The year is off to an exciting start for quantum computing leader D-Wave Quantum Inc. (NYSE: QBTS). The company has announced major new contracts, acquired key rival Quantum Circuits, and filed shelf registrations totaling roughly $330 million—moves that have raised investor concerns. As a result, QBTS shares are down nearly 20% year-to-date (YTD). As D-Wave pursues a dual strategy across quantum annealing and gate-model systems, the company is quietly expanding into the defense sector through an expanded partnership focused on U.S. air and missile defense. But will this project generate meaningful revenue for D-Wave, or is it another promising development that may not yet translate into sales or profitability? Inside D-Wave's Latest Collaboration With Davidson and AndurilThe late-January announcement describes a collaboration with defense and aerospace consultant Davidson Technologies and autonomous systems defense firm Anduril Industries. The partners aim to develop hybrid quantum-classical applications for U.S. air- and missile-defense planning scenarios. Early results are encouraging—D-Wave reported that a hybrid quantum-classical approach produced a tenfold reduction in time-to-solution and a 9%–12% improvement in threat mitigation. In a simulated 500-missile attack, the partnership intercepted an additional 45–60 missiles compared with earlier methods. D-Wave previously partnered with Davidson in early 2026, installing an Advantage2 quantum annealing system at Davidson's Alabama headquarters. That collaboration was intended to advance quantum research for defense applications with an eye toward serving the U.S. Department of Defense. Is Another Practical Application of D-Wave's Tech Emerging?This expansion builds on D-Wave's earlier work with Davidson and moves toward a concrete use case for the Advantage2 system. The Advantage2 has attracted less attention recently as D-Wave has emphasized traditional gate-model quantum developments, and last year's Davidson partnership was fairly open-ended—leaving investors uncertain about how defense-focused research would convert into sales. The 2026 announcement, however, includes practical performance data that suggests the approach could be marketable to government and military customers. As evidence accumulates that quantum-enhanced solutions can outperform classical systems for certain planning problems, the case strengthens that militaries could obtain strategic advantages by integrating D-Wave's technology. That said, D-Wave has not yet announced significant U.S. military contracts and would face strong competition if it expands further into defense. The company does not appear to be repositioning itself as a defense contractor; instead, it is demonstrating that quantum technology could have wide applications across industries. Investors may welcome the transformative potential, or they may worry D-Wave is spreading resources across too many initiatives—even with its substantial cash reserves—and risking success in any single area. Has D-Wave's Partnership With Davidson Moved the Needle For Analysts?It's unclear how much of Wall Street's reaction was driven specifically by the expanded defense partnership. By late January, Rosenblatt Securities, Needham & Co., and Canaccord Genuity had either reiterated Buy ratings or issued ambitious price targets for QBTS shares. D-Wave is broadly favored among analysts and carries a consensus price target above $38 per share—roughly 80% higher than where the stock was trading in mid-February. However, that analyst optimism may reflect a bundle of positive updates announced around the same time, including a major quantum-computing-as-a-service (QCaaS) agreement with a Fortune 100 company and the sale of an Advantage2 system to Florida Atlantic University, rather than the defense collaboration alone. What is clear is that the company continues to pursue multiple avenues for growth as the year progresses. Investors will need to judge whether D-Wave's multi-pronged approach is likely to deliver meaningful revenue and long-term profitability.

If you would like to unsubscribe from receiving offers for Strategic Fortunes, please click here. |

No comments:

Post a Comment