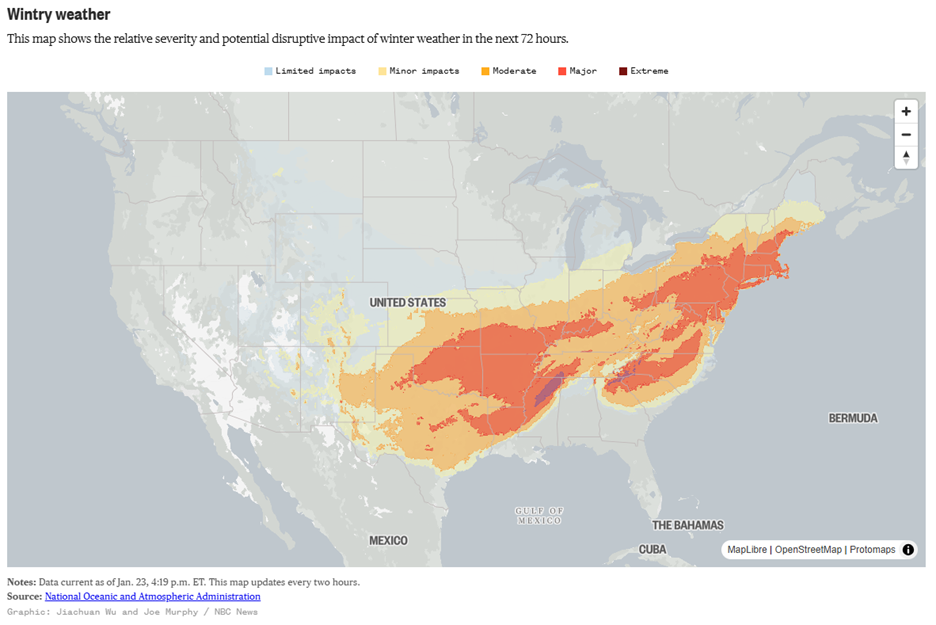

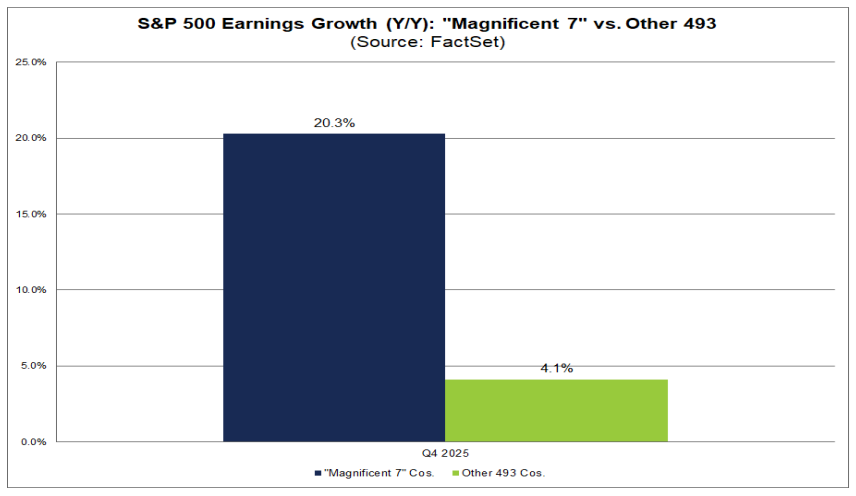

A Quiet Storm Is Brewing in the Market – Here's How to Prepare (Before It's Too Late) VIEW IN BROWSER You may have heard that a major winter storm is taking shape this weekend. Meteorologists say it could sprawl across multiple regions of the country – not as a quick burst of snow that’s gone by morning, but a wide, slow-moving system capable of laying down snow, ice and freezing temperatures over several days.  Source: NBC News These are the types of storms that cause the most damage. Not because they look frightening at first, but because they change conditions gradually until suddenly travel becomes impossible, power goes out and normal movement grinds to a halt. In situations like this, the most important decisions have to be made before any of that happens. Because once the roads are iced over, it’s too late. Markets work the same way. Despite all the distractions and international shocks, markets have remained resilient to start the year. At first glance, that feels reassuring. But what matters most right now isn’t how the market looks on the surface. It’s what’s happening underneath… That’s why, in today’s Market 360, I want to walk you through what’s changing beneath the surface – and why understanding this change matters right now. The Latest Market Distraction The bond vigilantes wreaked havoc on the stock market earlier this week. As you may know, there’s been an uproar surrounding President Trump’s demands to buy Greenland from Denmark. He initially threatened increased tariffs on U.S. allies in his quest to gain control of Greenland for national security reasons. The bond vigilantes (i.e., big institutional investors, insurance companies and sovereign wealth funds) don’t like all the tension between the U.S. and our NATO allies over the Greenland situation. So, they used the diplomatic chaos as an opportunity to drive global bond yields higher. In turn, all of the major indices sold off hard on Tuesday, with the S&P 500 falling 2% and the Dow dropping 1.8%. Trump’s later reassurance that the U.S. would not use force to acquire Greenland and his about-face on the tariff threats assuaged most folks’ concerns. So, the stock market erased the majority of its losses by the end of the week. Now, I have consistently said since January of last year that Trump 2.0 would be about bold, transformative policies. But what’s important to remember is that Trump's negotiating style often catches people off guard. He makes big demands, issues threats, talks to the media and posts on social media – all in the effort to make his adversaries uncomfortable. Ultimately, when a compromise “deal” is announced, it’s likely closer to the goal his administration had in mind all along. That was the case with the reciprocal tariffs back in April 2025, and it’s the same case this time around with Greenland. But the bottom line is that these are nothing less than market distractions, folks. In fact, there is something much more important happening beneath the surface that you need to be know about... What’s Happening Beneath the Surface Back on January 8, I shared a chart depicting “The Lost Decade”. From, 2000 to 2009, it was the period where stocks essentially flatlined. I also warned that we’re in danger of the same thing happening again. As I explained, a handful of mega-cap companies are carrying an outsized influence over the market – and investor’s portfolios. And if any sign of stagnation appears with these names, then investors would be wise to look elsewhere. Here’s what I mean... FactSet estimates that the S&P 500 will likely achieve average earnings growth of more than 14% for the fourth quarter. But in the chart below, you can clearly see how the Magnificent Seven stocks – Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla – are expected to do most of the heavy lifting...  Now, as I said back then, I am not calling for a “crash” in these stocks. But the fact is that Magnificent Seven stocks now represent an outsized share of major indexes and retirement portfolios. Many investors don’t realize just how concentrated their exposure has become. We’re talking about $21 trillion in market capitalization – or roughly one third of the S&P 500. They believe they’re diversified, but in reality, they’re making the same bet over and over again. My question is simply this: What happens when growth begins to slow at these massive companies? It creates what I call a “Hidden Crash”. Even modest underperformance from a couple of these stocks can drag the entire market down. It won’t happen overnight. When they stop growing fast enough, they act like anchors instead of engines, causing portfolios to tread water at best – or slowly sink over time. Where to Find the Next Market Leaders Just like with this weekend’s winter storm, the issue isn’t a lack of warnings. It’s that most people don’t act until conditions deteriorate. Markets are no different. That’s why avoiding stagnation is only the first step. Because pretty soon, a good portion of that $21 trillion will go looking for growth elsewhere. In cycles like this, the stocks that benefit most tend to operate at the edges of major economic shifts. They sit deep inside supply chains. They solve critical problems that the giants cannot efficiently handle themselves. I call these companies Edge Innovators. These are not the household names everyone already owns. They are the companies supplying the infrastructure that makes the next phase of the AI Revolution possible. The chips. The systems. The networks. The specialized technology Big Tech must buy, whether profits rise or fall. And right now, that spending is exploding. We are in the middle of the largest infrastructure buildout in modern American history. Roughly $2.8 trillion is flowing into artificial intelligence, data centers, advanced computing and digital networks. That money does not stay inside the tech giants. It flows outward to the companies building the backbone of this new economy. The fact is, though, most investors have no idea about these stocks. And that is where opportunity lies... Why This Matters Right Now Just like with the winter storm moving across the country right now, the most important decisions are made before conditions force your hand. By the time everyone else reacts, the damage is already done. That’s why I put together a special presentation on this “Hidden Crash”. In it, I break down the warning signs most investors never see – the quiet earnings weakness, the growing concentration risk, and the early rotation happening beneath the surface of the market. More importantly, I show you where that money is actually going. Not into the same seven stocks everyone already owns, but into a small group of Edge Innovators positioned to benefit directly from the next phase of AI and infrastructure spending – without carrying Big Tech valuations or Big Tech risk. I walk through the framework I’m using to identify these companies, explain why a handful are already pulling away from the pack, and reveal my top Edge Innovator pick – ticker symbol and all. If you haven’t watched the presentation yet, I strongly encourage you to do so now. Sincerely, |

No comments:

Post a Comment