Two new downbeat data points on jobs… but Louis Navellier sees big GDP growth this year… why Luke Lango says unemployment will hit 6%… be careful about owning mega-cap tech… my own 2026 prediction VIEW IN BROWSER “The United States is in a hiring recession.” That’s how one analyst put it based on yesterday’s Job Openings and Labor Turnover Survey (JOLTS) report. The report showed 7.15 million job openings at the end of November, versus Bloomberg economists’ estimates of about 7.6 million. But two other data points catch the eye. First, the hiring rate fell to 3.2% – one of the weakest readings since the Great Recession. In fact, since 2013, only April of 2020 showed a lower hiring rate. Second, the quits rate – often viewed as a gauge for workers’ confidence – came in at 2%. This reflects caution. Workers are more hesitant to leave their positions because they perceive fewer available alternatives or fear not being able to find a new job quickly. Meanwhile, this morning brought another downbeat data point… The latest report from outplacement firm Challenger, Gray & Christmas found that employers announced 1,206,374 job cuts last year – an increase of 58% over the number in 2024. Plus, planned hires are down. From the report: Annual job cuts are at the highest level since 2020, when 2,304,755 cuts were announced. It is the seventh highest annual total since 1989… Last year, U.S. employers announced 507,647 planned hires, down 34% from the 769,953 announced in 2024. It is the lowest year-to-date total since 2010, when 402,608 new hires were planned that year. These two data points come on the heels of November’s unemployment rate, which jumped to 4.6% That was the highest level in more than four years. You’ll recall that the Fed’s updated dot plot in December showed policymakers expected unemployment to peak at 4.5% in 2025 before beginning to ease lower. Tomorrow, we get the updated employment report, and the forecast is for the unemployment rate to fall to 4.5%. But even if that happens, our technology expert, Luke Lango of Innovation Investor, believes it won’t stay that low for long. At the end of December, Luke published his 2026 predictions. One of them is that unemployment will top 6% this year. We’ll circle back to Luke’s rationale in a moment. But first, if you think 6% unemployment means we’re on the verge of a widespread recession that hobbles the stock market, hold on. Legendary investor Louis Navellier just made his own 2026 predictions Two of them relate to Luke’s unemployment call. The first? U.S. GDP will soar to 5% this year. From Louis: I believe economic growth could accelerate meaningfully in 2026. Key interest rate cuts and the ongoing data center boom, coupled with a shrinking trade deficit and increased onshoring, could converge to boost U.S. GDP growth to at least 5% in 2026. The investment legend sees this economic strength translating into earnings growth: Earnings momentum is expected to accelerate further. Fourth-quarter earnings are now forecast to increase 8.1%, up from estimates for 7.2% at the end of September… After that, earnings and revenue are expected to accelerate in 2026, driven by higher guidance, especially from data center companies with a growing order backlog. FactSet currently projects earnings will accelerate to a 14.5% annual pace in calendar year 2026. So, how is it that this year could bring spiking unemployment at the same time that earnings accelerate and productivity skyrockets? It seems logically inconsistent. If you’re a regular Digest reader, you already know the answer… AI is severing the relationship between human labor and productivity. It’s time to throw the old model out the window The economic relationship we’re familiar with is that “more labor” equals “more productivity.” By the same token, if more people are losing their jobs, that must mean economic output is shrinking, which brings a recession into the conversation. No more. In today’s AI economy, the traditional labor/productivity relationship is weakening as technology begins to replace labor on a large scale. Let’s return to Luke: If you can produce the same output with fewer labor hours, GDP can remain strong even as unemployment rises. That’s not just plausible – it’s arguably the most likely equilibrium for a maturing automation wave. This reinforces the “haves versus have-nots” / “K-shaped economy” dynamic that we’ve highlighted for months In the upper spoke of this “K,” Americans with assets feel confident, watching their brokerage statements and home values climb. In the lower spoke, Americans without assets face high retail prices and paychecks that aren’t keeping up with inflation. The result is that sentiment has sunk to near its lowest reading on record, according to the December University of Michigan survey. Circling back to this year’s GDP – potentially at 5%+ as Louis believes – Luke makes a key point: GDP is not a happiness index. It doesn’t matter if the output comes from 100 million workers or 80 million workers plus machines. GDP just counts output, which means we could see something like this: - Weak or negative employment growth

- Strong productivity growth

- Strong investment (AI capex, software spend, automation equipment)

- Surprisingly robust GDP

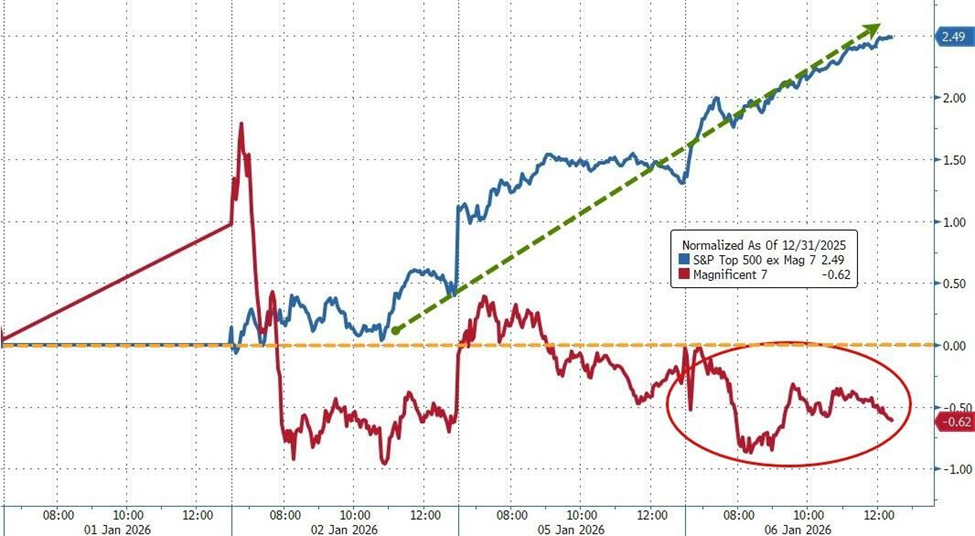

As we’ve been hammering home in the Digest, AI is a massive wealth concentration device. In the past, I’ve used the analogy of a billiards table filled with pool balls. Imagine hoisting up a corner of the table so that all the balls roll into a single pocket. That’s the financial impact of AI on the concentration of global wealth. AI is lifting the billiards table… the pool balls are global capital… and the one pocket collecting everything belongs to the owners of businesses that effectively harness AI. The rest – the companies that can’t adapt and the workers replaced by AI/automation – get left behind. Given this, it’s easy to see how we get both 5% GDP and 6% unemployment, and why – as Luke puts it – “the U.S. will feel like it’s booming and struggling at the same time… because it will be.” So, what’s the action step? First, from an employment perspective, unless you feel confident about a new opportunity, be careful about trying to job-switch. Instead, harness the power of AI to become more productive – and valuable – in your current job. This could be very important as managers look to trim headcount this year. As Fed Chair Jerome Powell put it, and as the jobs data we highlighted earlier in this Digest shows, we’re in a “low hire, low fire” jobs market. It’ll be difficult to invest in AI if you have no disposable income because of a job loss from AI. Second, align your investing interests with that one billiards pocket receiving all the pool balls. But here’s where we need to be careful… For the last several years, the hyperscaler “Mag 7” stocks have been the primary way to gain AI exposure Be careful about expecting that same outperformance going forward. Today, Louis believes too many portfolios are dangerously concentrated in mega-cap tech stocks, including the Magnificent Seven. Worse, too many investors don’t even realize it because it’s happening through index funds and retirement target date funds. To be clear, Louis doesn’t expect these stocks to crash overnight, but rather, suffer years of stagnation. Meanwhile, he sees the biggest opportunities coming from a new batch of winners that make the AI boom possible. So, if you’re still overweight in the Mag 7s/mega-cap AI, you’re at risk of suffering a very real opportunity cost, missing out on where the big money will be shifting this year. By the way, the numbers suggest this has already begun. As you can see below, the Mag 7 stocks have significantly trailed the rest of the market so far this year. As of Tuesday, the S&P 493 was up 2.5% while Mag 7 had fallen 0.6%…

Source: Zerohedge / Bloomberg There’s already a social media name for this… Instead of the “Mag 7,” we now have the “Lag 7.” Here’s Louis: We’re entering a market environment where productivity gains, AI-driven efficiency and scale advantages matter more than ever. Some companies are accelerating. Others are quietly falling behind, even as the broader market moves higher. That split is already underway. Louis just released a short video briefing that digs into what’s happening – and where he sees the most significant opportunities right now. From Louis: The next 60 to 90 days may represent a critical window — before institutional money fully floods into this space. In my brand-new Hidden Crash 2026 briefing, I break down: - Where the hidden concentration risk really lies

- Why broad market funds may disappoint for years

- How smart money is quietly rotating right now

- And how investors can reposition without touching options, crypto, or high-risk speculation

I want to cover more ground today, but you can watch Louis’ briefing right here. So, what will all this do to the “K” and our social divide this year? Well, it keeps expanding. Back to Luke: [This year,] you’ll hear things like: - “The economy is booming, but nobody feels safe.”

- “Inflation is falling, but rent is still brutal.”

- “The stock market is happy, but households are stressed.”

If you own productive assets and can leverage AI, 2026 could feel like a golden age. But if your job is task-based and easily automated, 2026 could feel like a meat grinder. Now, I’m going to wrap up today using Luke’s analysis as a jumping-off point to make my own 2026 prediction tied to today’s themes. Economic frustration will usher in new legislative tax proposals that hit the Upper-K History shows that large and persistent economic splits don’t stay contained. Over time, they tend to produce policy responses – particularly at the local and state level. And those policy changes can materially affect asset values. We’re already seeing early signals. As we’ve profiled in the Digest, the mayoral win in New York City for Democratic Socialist Zohran Mamdani reflects growing pressure around housing affordability. That pressure could translate into meaningful changes for real estate owners, landlords, and developers if enacted. Similarly, a handful of states (California, Illinois, Washington, Vermont) have begun exploring possible legislation that would tax unrealized capital gains. In plain English, that means taxing gains on stocks or other assets even if they haven’t been sold. To be clear, these proposals are currently aimed only at ultra–high-net-worth households. But history suggests these things rarely stop exactly where they start. (On that note, if you have the time, revisit what the Alternative Minimum Tax was originally intended to do versus what it eventually became.) From an investor’s standpoint, the takeaway isn’t whether these ideas are “right” or “wrong,” but that the policy backdrop is becoming more reactive to today’s widening K-shaped economy. And that matters, because portfolio values are at the mercy of laws. So, my prediction is this: This year will bring a wave of new, controversial legislative proposals aimed at investment wealth – proposals that may not pass immediately, but will introduce a new layer of policy risk investors will have to price in. Coming full circle Stepping back, the signal from the labor market is clear: hiring is slowing, workers are staying put, and unemployment is at risk of running much higher than policymakers expected. At the same time, Luke’s call for higher unemployment and Louis’ outlook for strong GDP and accelerating earnings aren’t contradictions – they’re two sides of the same AI-driven economy where productivity and profits can surge even as fewer workers are needed. So, our investment opportunity this year lies in owning companies harnessing AI-driven efficiency. But as Louis’ latest briefing shows, selectivity matters more than ever. As for my prediction on proposals targeting investment wealth, we’ll revisit this a year from now. Have a good evening, Jeff Remsburg |

No comments:

Post a Comment